louis vuitton stakeholders | Investors and analysts louis vuitton stakeholders EVENTS& PRESS RELEASES. Social and key environmental indicators, key LVMH bodies and stakeholders: you will find in this section, key information about the sustainable development policy of the LVMH group. Did you ever get help with your flycolor 30a esc's? In case you didn't, they are the exact same as Hobbyking F30A's. Flycolor is the OEM manufacturer of HK F series. The pins are as in the picture here: https://static.rcgroups.net/forums/a.byking_20A.jpg They run bs_nfet.hex SimonK .

0 · Who Owns LVMH: The Largest Shareholders Overview

1 · Our mission

2 · Louis Vuitton SWOT Analysis

3 · LVMH: Shareholders Board Members Managers and Company

4 · LVMH

5 · Investors and analysts

6 · How LVMH Dominates the Luxury Business

7 · Brand Strategies that made LVMH luxury powerhouse

8 · Being a LVMH shareholder

9 · 6 Companies Owned by LVMH (Moët Hennessy Louis Vuitton

Premium-quality ATF for Ford and Lincoln transmissions. Provides excellent performance in electronically controlled automatic transmissions. Manufactured with high-viscosity index, premium-quality, hydroprocessed base oils and specially designed performance additives.

EVENTS& PRESS RELEASES. Social and key environmental indicators, key LVMH bodies and stakeholders: you will find in this section, key information about the sustainable development policy of the LVMH group.Business description: LVMH. LVMH Moët Hennessy Louis Vuitton SE is the world leader in luxury products. Net sales break down by family of products as follows: - fashion and leather items .

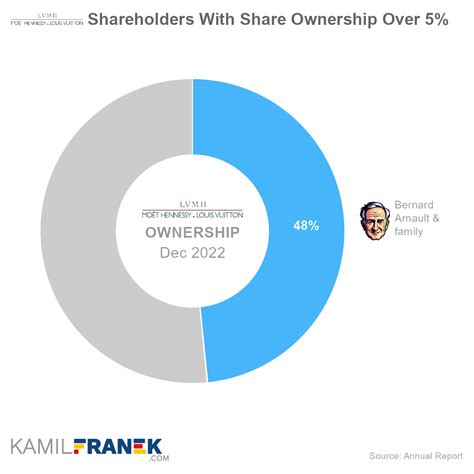

Bernard Arnault & family is the largest shareholder of LVMH, owning 48.4% of its shares. However, Bernard Arnault & family controls 63.9% of all votes thanks to owning .Louis Vuitton needs to continue focusing on sustainability and social responsibility initiatives to maintain its appeal to environmentally and ethically conscious consumers. Check out the .In 1987, Moet Hennessy and Louis Vuitton merged to create LVMH. Following different visions of the future of the Group, Alain Chevalier and Henri Racamier, respective leaders of MH and LV, started to fight. Racamier invited Bernard . Sheer scale, diversification and the exceptional resilience of its leather goods megabrand Louis Vuitton allow the group to consistently generate strong revenue and profit .

Committed to positive impact, LVMH actively supports social, environmental and cultural initiatives with a long-term vision, in order to make a lasting difference. The Group works closely with .Founded in 1987, LVMH was created by the merging of Moët Hennessy and Louis Vuitton, marking the beginning of a new era in luxury. Bernard Arnault has headed the Group since 1989 and is its majority shareholder with a clear . What do Dior couture gowns, Sephora stores, Fenty Beauty by Rihanna, Louis Vuitton luggage and Moet et Chandon champagne have in common? Them and about 66 .

EVENTS& PRESS RELEASES. Social and key environmental indicators, key LVMH bodies and stakeholders: you will find in this section, key information about the sustainable development policy of the LVMH group.Business description: LVMH. LVMH Moët Hennessy Louis Vuitton SE is the world leader in luxury products. Net sales break down by family of products as follows: - fashion and leather items (48.9%): brands such as Louis Vuitton, Kenzo, Celine, Fendi, Marc Jacobs, Givenchy, etc.; Bernard Arnault & family is the largest shareholder of LVMH, owning 48.4% of its shares. However, Bernard Arnault & family controls 63.9% of all votes thanks to owning double-voting shares. As of December 2022, the market value of Bernard Arnault & family’s stake in LVMH was 5.8 billion.

Who Owns LVMH: The Largest Shareholders Overview

Louis Vuitton has been led by chair and CEO Bernard Arnault since 1989. Arnault took a majority stake in the company and has since guided LVMH in a fast-paced acquisition spree, picking up.Louis Vuitton needs to continue focusing on sustainability and social responsibility initiatives to maintain its appeal to environmentally and ethically conscious consumers. Check out the SWOT Analysis of Global Businesses

In 1987, Moet Hennessy and Louis Vuitton merged to create LVMH. Following different visions of the future of the Group, Alain Chevalier and Henri Racamier, respective leaders of MH and LV, started to fight. Racamier invited Bernard Arnault to invest in LVMH.

Sheer scale, diversification and the exceptional resilience of its leather goods megabrand Louis Vuitton allow the group to consistently generate strong revenue and profit growth, giving the group a less cyclical profile, adding to its overall strength and valuation multiple.

Committed to positive impact, LVMH actively supports social, environmental and cultural initiatives with a long-term vision, in order to make a lasting difference. The Group works closely with numerous stakeholders that address important social issues.

Founded in 1987, LVMH was created by the merging of Moët Hennessy and Louis Vuitton, marking the beginning of a new era in luxury. Bernard Arnault has headed the Group since 1989 and is its majority shareholder with a clear vision: to make LVMH the world leader in luxury goods. What do Dior couture gowns, Sephora stores, Fenty Beauty by Rihanna, Louis Vuitton luggage and Moet et Chandon champagne have in common? Them and about 66 other iconic brands belong to the world’s first and now largest luxury group, LVMH, or Louis Vuitton Moët Hennessy.EVENTS& PRESS RELEASES. Social and key environmental indicators, key LVMH bodies and stakeholders: you will find in this section, key information about the sustainable development policy of the LVMH group.

Business description: LVMH. LVMH Moët Hennessy Louis Vuitton SE is the world leader in luxury products. Net sales break down by family of products as follows: - fashion and leather items (48.9%): brands such as Louis Vuitton, Kenzo, Celine, Fendi, Marc Jacobs, Givenchy, etc.; Bernard Arnault & family is the largest shareholder of LVMH, owning 48.4% of its shares. However, Bernard Arnault & family controls 63.9% of all votes thanks to owning double-voting shares. As of December 2022, the market value of Bernard Arnault & family’s stake in LVMH was 5.8 billion. Louis Vuitton has been led by chair and CEO Bernard Arnault since 1989. Arnault took a majority stake in the company and has since guided LVMH in a fast-paced acquisition spree, picking up.

Louis Vuitton needs to continue focusing on sustainability and social responsibility initiatives to maintain its appeal to environmentally and ethically conscious consumers. Check out the SWOT Analysis of Global BusinessesIn 1987, Moet Hennessy and Louis Vuitton merged to create LVMH. Following different visions of the future of the Group, Alain Chevalier and Henri Racamier, respective leaders of MH and LV, started to fight. Racamier invited Bernard Arnault to invest in LVMH. Sheer scale, diversification and the exceptional resilience of its leather goods megabrand Louis Vuitton allow the group to consistently generate strong revenue and profit growth, giving the group a less cyclical profile, adding to its overall strength and valuation multiple.

Committed to positive impact, LVMH actively supports social, environmental and cultural initiatives with a long-term vision, in order to make a lasting difference. The Group works closely with numerous stakeholders that address important social issues.Founded in 1987, LVMH was created by the merging of Moët Hennessy and Louis Vuitton, marking the beginning of a new era in luxury. Bernard Arnault has headed the Group since 1989 and is its majority shareholder with a clear vision: to make LVMH the world leader in luxury goods.

Our mission

who sells fendi bags

pokemon and fendi

pokemon and fendi

Louis Vuitton SWOT Analysis

Motorcraft MERCON LV is a premium-quality automatic transmission fluid recommended by Ford Motor Company for use in Ford, Lincoln and Mercury vehicles that require MERCON LV type fluid. This product also provides excellent performance in electronically controlled automatic transmissions.

louis vuitton stakeholders|Investors and analysts