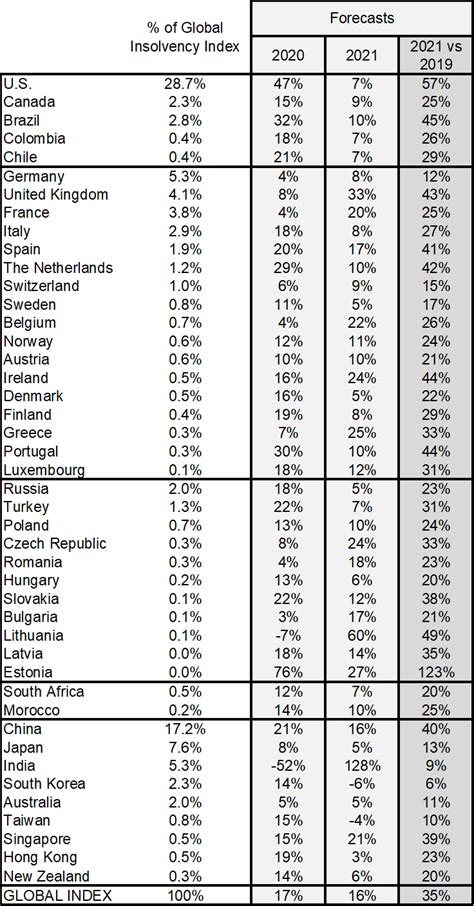

euler hermes coronavirus | CALM BEFORE THE STORM: COVID 19 AND THE euler hermes coronavirus Euler Hermes’ global insolvency index is expected to reach a record high of +35% cumulated over a two-year period (after +17% in 2020 and +16% in 2021) as the global economy faces a U-shaped recovery from the Covid-19 crisis.

Compared to an authentic belt, the “LV” buckle on a fake is often rounded, not straight, not as sharply or finely cut, and too thick or thin. [1] Look at the buckle’s color, too. The “LV” logo might be duller than a real “LV” logo and the hue may look off. For instance, a fake gold “LV” logo might be too brassy.

0 · The insolvency time bomb: prepare for a record

1 · CALM BEFORE THE STORM: COVID 19 AND THE

2 · Allianz

One of the key aspects in determining the authenticity of a Louis Vuitton belt is examining its identification number located on the backside. A genuine Damier Azur belt should have an ‘M9609’ identification number.

The coronavirus pandemic is leaving deep scars on the global economy. .

Euler Hermes’ global insolvency index is expected to reach a record high of +35% cumulate.Euler Hermes’ global insolvency index is expected to reach a record high of +35% cumulated .from the Covid-19 shock, the rise in insolvencies could increase by as much as +50pp to . The coronavirus pandemic is leaving deep scars on the global economy. According to the world's leading credit insurer Euler Hermes, this will likely to lead to a deep recession in world trade and the global economy – and .

Euler Hermes’ global insolvency index is expected to reach a record high of +35% cumulated over a two-year period (after +17% in 2020 and +16% in 2021) as the global economy faces a U-shaped recovery from the Covid-19 crisis.from the Covid-19 shock, the rise in insolvencies could increase by as much as +50pp to +60pp. However, while further support for companies will limit insolvencies in the short-term, it could also prop up zombie companies, raising the risks of more insolvencies in the medium and long term. EXECUTIVE SUMMARY Allianz Research Maxime Lemerle

The insolvency time bomb: prepare for a record

BALTIMORE, June 23, 2020 /PRNewswire/ -- According to a survey released today by Euler Hermes Americas, the world's largest trade credit insurer, 93% of CFOs and their direct reports say their. While the Covid-19 crisis reaffirmed the critical role of credit insurance in sustaining global trade, Euler Hermes will help businesses catch the upswing in still uncertain times. According to a report by insurer Euler Hermes, the effects of the COVID-19 pandemic will be felt most severely in 2021 when it comes to business insolvencies.

Despite sparking a slump in global GDP and trade in 2020, the Covid-19 shock did not translate into a wave of insolvencies. In fact, our Global Insolvency Index not only ended 2020 with a -12% y/y drop, but the decline remained steady and broad-based all along the year. BALTIMORE and PRINCETON, N.J., July 10, 2020 /PRNewswire/ -- As economic uncertainty due to COVID-19 continues to impact businesses across the country, a new report commissioned by trade credit. While the Covid-19 crisis reaffirmed the critical role of credit insurance in sustaining global trade, Euler Hermes will help businesses catch the upswing in still uncertain times. These nominations embody the company’s ambition to accompany their clients in the new growth cycle and to further set the standard for best-in-class customer .Coronavirus pandemic: Euler Hermes Germany participates in protective shield for German companies and suppliers. German Credit insurers and the German Federal Government reach a joint, far-reaching agreement to protect German companies and their supply chains in times of .

The coronavirus pandemic is leaving deep scars on the global economy. According to the world's leading credit insurer Euler Hermes, this will likely to lead to a deep recession in world trade and the global economy – and .

Euler Hermes’ global insolvency index is expected to reach a record high of +35% cumulated over a two-year period (after +17% in 2020 and +16% in 2021) as the global economy faces a U-shaped recovery from the Covid-19 crisis.from the Covid-19 shock, the rise in insolvencies could increase by as much as +50pp to +60pp. However, while further support for companies will limit insolvencies in the short-term, it could also prop up zombie companies, raising the risks of more insolvencies in the medium and long term. EXECUTIVE SUMMARY Allianz Research Maxime LemerleBALTIMORE, June 23, 2020 /PRNewswire/ -- According to a survey released today by Euler Hermes Americas, the world's largest trade credit insurer, 93% of CFOs and their direct reports say their. While the Covid-19 crisis reaffirmed the critical role of credit insurance in sustaining global trade, Euler Hermes will help businesses catch the upswing in still uncertain times.

According to a report by insurer Euler Hermes, the effects of the COVID-19 pandemic will be felt most severely in 2021 when it comes to business insolvencies. Despite sparking a slump in global GDP and trade in 2020, the Covid-19 shock did not translate into a wave of insolvencies. In fact, our Global Insolvency Index not only ended 2020 with a -12% y/y drop, but the decline remained steady and broad-based all along the year.

BALTIMORE and PRINCETON, N.J., July 10, 2020 /PRNewswire/ -- As economic uncertainty due to COVID-19 continues to impact businesses across the country, a new report commissioned by trade credit. While the Covid-19 crisis reaffirmed the critical role of credit insurance in sustaining global trade, Euler Hermes will help businesses catch the upswing in still uncertain times. These nominations embody the company’s ambition to accompany their clients in the new growth cycle and to further set the standard for best-in-class customer .

CALM BEFORE THE STORM: COVID 19 AND THE

660 likes, 26 comments - gu.lv.liberation on April 3, 2019: " Guam Liberation-Las Vegas Miss Tutuhan (Agana-Heights) 2019 Lorin Rose Le .

euler hermes coronavirus|CALM BEFORE THE STORM: COVID 19 AND THE